Organic Chemistry Homework Question 2026 | Nanyang Technological University

Organic Chemistry Homework Question

Question 1

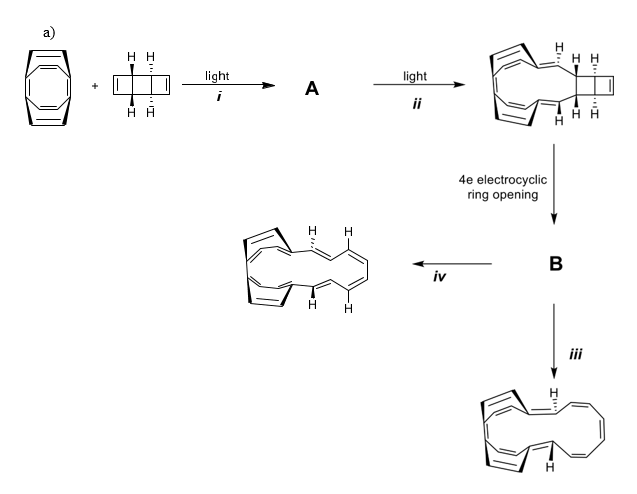

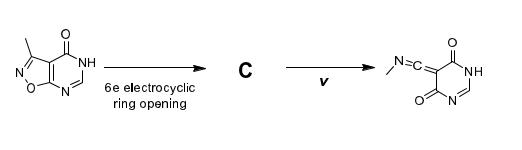

For the reactions sequence shown below, draw the structures of compounds A, B, C, D and E and name the reactions i, ii, iii, iv, v and vi. Using arrows show how the reaction takes place. A detailed mechanism and stereochemistry are not necessary.

a)

b)

c)

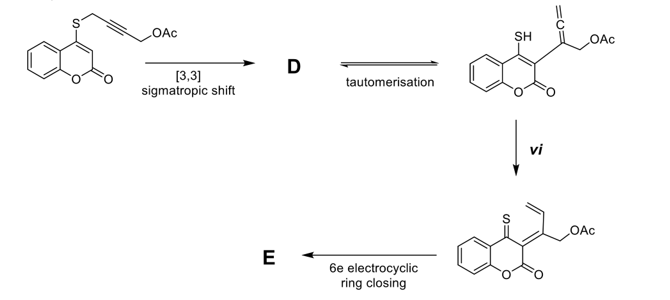

Question 2

Upon heating compound F undergoes either a 4-atom tether intramolecular hetreo-Diels-Alder or 4 atoms tether intramolecular Diels-Alder leading to compounds H and G respectively.

a) Draw the structures and compounds G and H.

(5 marks)

b) For the formation of one of the compounds (either H or G) propose a detailed mechanism, showing the formation of all the possible isomers.

(12 marks)

Struggling with Organic Chemistry Homework Questions at NTU Singapore?

Native Singapore Writers Team

- 100% Plagiarism-Free Essay

- Highest Satisfaction Rate

- Free Revision

- On-Time Delivery

The post Organic Chemistry Homework Question 2026 | Nanyang Technological University appeared first on Singapore Assignment Help.