BCAF003 Business Accounting Assignment: A Comprehensive Study on Bank Reconciliation, Cash Controls, Inventory Valuation, and Financial Analysis

Temasek Polytechnic School of Business AY2025/26 April Semester Individual Assignment 2 (weightage 40%)

Question 1 (26 marks)

PART A (11 marks)

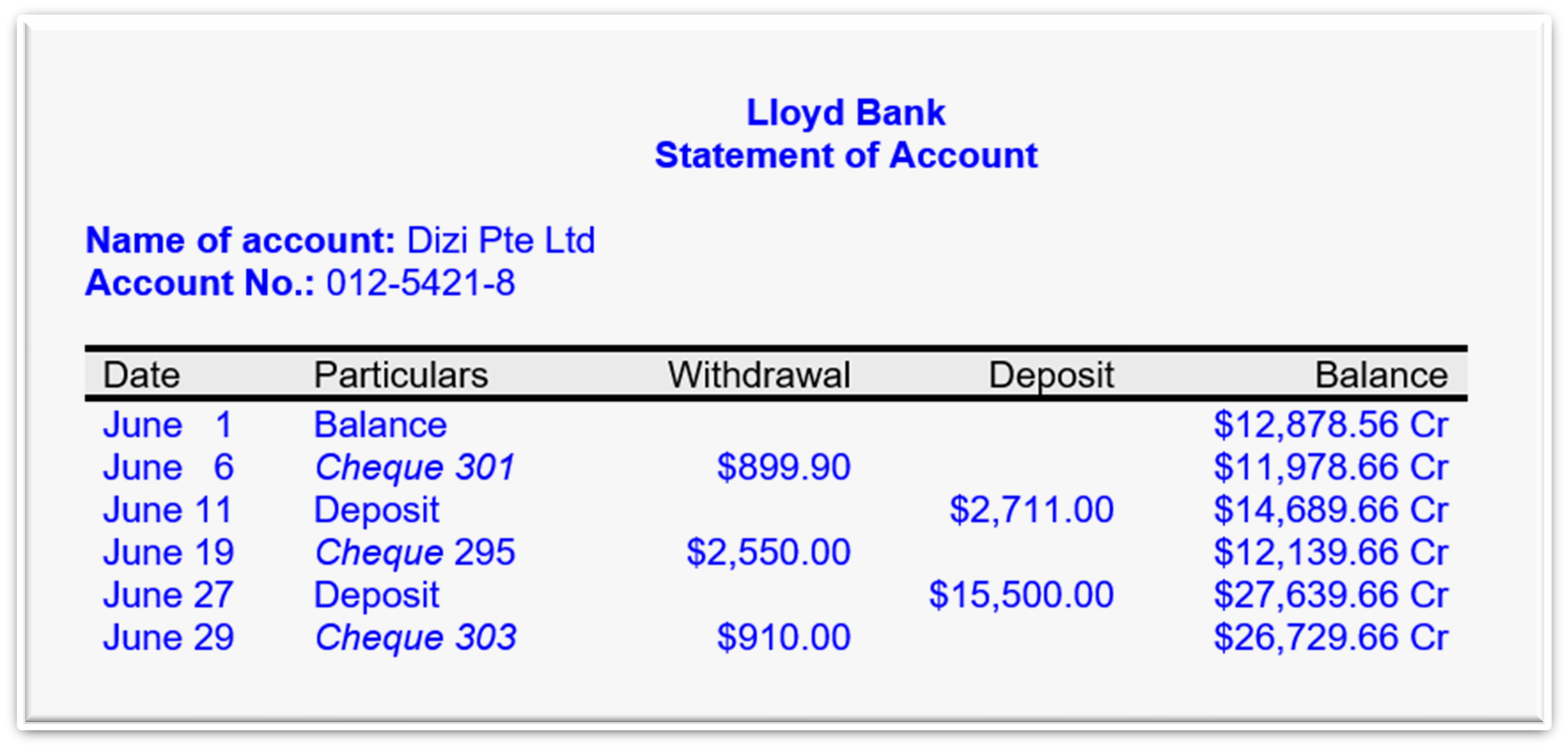

Dizi Pte Ltd received its June bank statement from Lloyd Bank:

After reviewing the records, the business discovered that $3,221.08 deposited on 30 June had not yet been recorded in the bank statement.

In addition, the business incorrectly recorded a receipt of $1,120 from a debtor as $1,210 in the debtor’s account.

It also found that the following issued cheques have not yet been presented to the bank:

| Cheque No. | Amount ($) |

|---|---|

| 298 | 2,780.45 |

| 300 | 800.11 |

| 304 | 4,676.50 |

Required:

Prepare the bank reconciliation statement as at 30 June 2025.

(11 marks)

PART B (15 marks)

Cash is the lifeblood of every business organisation and is highly vulnerable to embezzlement.

Research and submit one newspaper article related to a cash embezzlement case. Attach the article as an appendix on page 11, ensuring the title, publisher and publication date are clearly stated.

(2 marks)

From the article, answer the following questions in your own words:

a) Describe how the offence was committed.

(2 marks)

b) Describe how the embezzlement was discovered.

(3 marks)

c) (i) Identify and explain two weaknesses in the internal controls applicable to your selected article.

(ii) Propose an effective control procedure to address each of the two weaknesses identified in (i) to prevent their recurrence.

Provide your answer using the table below.

(8 marks)

| Internal Control Weakness | Proposed Control Procedure |

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Native Singapore Writers Team

- 100% Plagiarism-Free Essay

- Highest Satisfaction Rate

- Free Revision

- On-Time Delivery

Question 2 (26 marks)

Brew & Bloom sells DawnMist, a calming herbal tea blend of chamomile, lemongrass, and lavender.

On 1 April 2025, the business had 1,500 boxes that cost $4.20 each and purchased more units in April:

| April | |

|---|---|

| 11 | 2,000 units at $4.60 each |

| 21 | 1,500 units at $4.80 each |

| 30 | 2,500 units at $5.40 each |

The business uses First-In First-Out (FIFO) costing method under the perpetual inventory system.

Required:

a) Complete the following stock card.

(19 marks)

| Date | Details | In | Out | Balance | ||||||

| 2025

Apr |

Qty | Unit

Cost $ |

Total Cost

$ |

Qty | Unit Cost

$ |

Total Cost

$ |

Qty | Unit Cost

$ |

Total Cost

$ |

|

| 1 | Balance | |||||||||

Note: Add additional rows as required.

b) Compute the total cost of inventory as at 30 April 2025.

(2 marks)

c) Compute the gross profit for the month ended 30 April 2025.

(5 marks)

Question 3 (14 marks)

UrbanGrind Pte Ltd operates a chain of cafés across Singapore, offering a stylish speciality coffee experience to its customers. The company’s accounting year ends on 31 March.

The company uses custom-built espresso machines designed for precision extraction and consistent quality, and commercial coffee grinders with advanced burr systems that ensure uniform grind size for optimal flavour extraction, providing customers with high-quality coffee while ensuring long-term operational efficiency.

Details of its espresso machines and coffee grinders are as follows:

The business adopts the straight-line method of depreciation. Do not provide an answer, as this is an assignment

Required:

a) Compute the total annual depreciation expense for each type of machine.

(6 marks)

b) Show how the cleaning machines would be presented in the Classified Balance Sheet as at 31 March 2025.

(8 marks)

Buy Custom Answer of This Assessment & Raise Your Grades

Question 4 (14 marks)

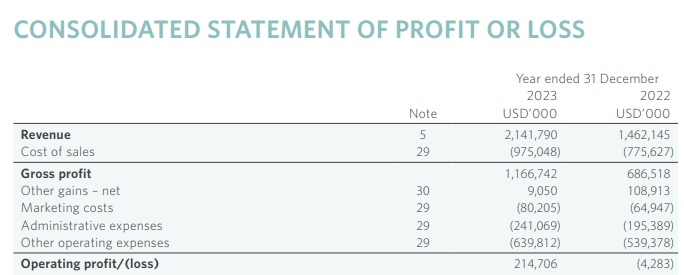

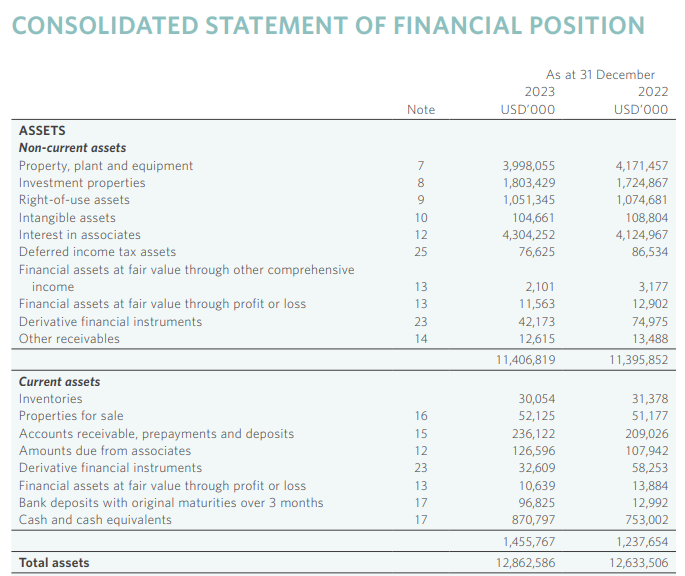

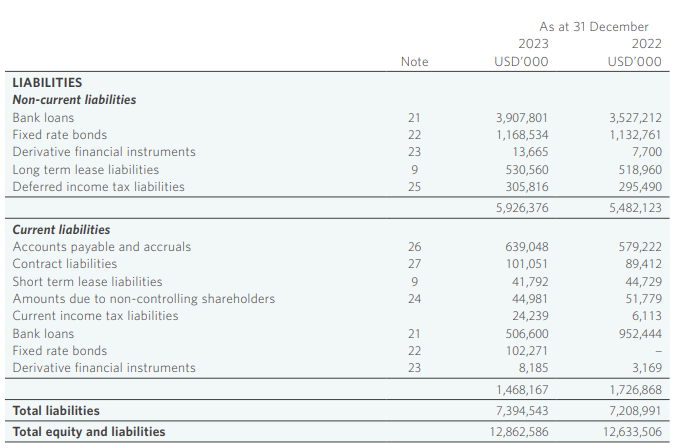

You are provided with the financial statement of a limited liability company. The group is involved in developing, owning, and running hotel and investment properties, offering hotel management and related services, and undertaking property development for sale.

Below are the extracts of the Consolidated Statement of Profit or Loss and Balance Sheet (Consolidated Statements of Financial Position) for the years ended 31 December 2022 & 2023:

Required:

a) Calculate the following ratios for the Group for the years ended 31 December 2022 & 2023 by completing the table Round off your answers to 2 decimal places.

(5 marks)

| 2023 | 2022 | |

| i) Gross Profit margin

= Gross profit x 100 Revenue |

||

| ii) Net Profit margin

= Profit x 100 Revenue |

|

|

| iii) Current ratio

= Current Assets Current Liabilities |

b) Using the information in the financial statements and ratios computed in part a), comment on the group’s financial performance and liquidity position.

(9 marks)

Stuck with a lot of homework assignments and feeling stressed ?

Take professional academic assistance & Get 100% Plagiarism free papers

The post BCAF003 Business Accounting Assignment: A Comprehensive Study on Bank Reconciliation, Cash Controls, Inventory Valuation, and Financial Analysis appeared first on Singapore Assignment Help.