Assessment Task

You are required to produce a budget report, complete with analysis and commentary, on a given scenario.

The report consists of THREE compulsory parts.

- You MUST submit an Excel spreadsheet with your report to demonstrate your Excel skills.

- Students who fail to submit an Excel spreadsheet, or who only provide a screenshot of Excel within their reports, not achieve full marks.

Do You Need Assignment of This Question

Assessment Scenario

Linda Ltd is an established heavy equipment manufacturer operating across the UK and Europe. The directors of Linda Ltd are considering expanding manufacturing of their new Heavy Electric Equipment (HEE), named the Linda David, over the next 12 months.

PART A:

The directors of Linda Ltd have asked you, as a recently employed assistant management accountant, to prepare and review their cash budget. Their bookkeeper started the cash budget but was unable to complete it due to ill health.

In addition, Linda Ltd requires you to evaluate the different funding options for its expansion plans.

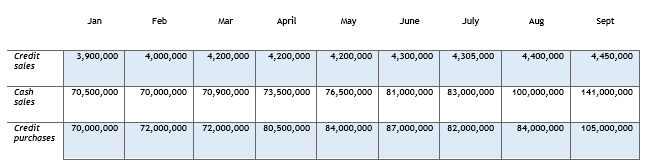

Estimated sales and purchases for each of the nine months till September are given below:

Trade Receivables: Credit sales are to be collected one month after the date they have been sold.

Trade Payables: Credit purchases are to be paid one month after the date they have been purchased.

Borrowings: The terms of a 3-year loan are coming to an end and Linda Ltd are due to repay the capital of £30,000,000 on 31st July.

Current Liabilities: Corporation tax of £500,000 is due to be paid to HMRC in the beginning of May.

Other overheads: Other overheads will be £7,000,000 per month settled on a monthly basis in the month incurred.

Cash: Linda Ltd expects to have £10,000 overdraft at the beginning of April.

You are required to:

Use Excel to prepare a cash budget for the business for the 6-month period from April to September

2. Examine the cash budget you have prepared and advise the directors of Linda Ltd of any possible solutions to solve any cash flow problems that might be evident. You should conduct appropriate research using academic sources to generate ideas and discussion. Marks will be awarded depending on the depth of discussion. (10% weighting)

3. Linda Ltd are listed on the London Stock Exchange and are considering raising finance for the expansion plans through the issue of shares. You have been asked to identify additional suitable sources of finance that may be available to Linda Ltd. You should consider the advantages and disadvantages of the sources of finance you have identified, including the issue of shares. You should then make a recommendation to the directors of Linda Ltd of the most appropriate source of finance for the proposed expansion plans. You should conduct appropriate research using academic sources to generate ideas and discussion. Marks will be awarded depending on the depth of discussion. (10% weighting)

Buy Answer of This Assessment & Raise Your Grades

PART B

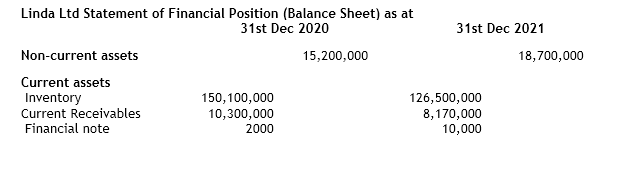

The Directors of Linda Ltd are considering expanding manufacturing of their new Heavy Electric Equipment (HEE), named the Linda David, over the next 12 months. Linda Ltd have asked you to calculate and compare ratios for 2020 and 2021 before making a recommendation as to whether to proceed with expansion plans or not.

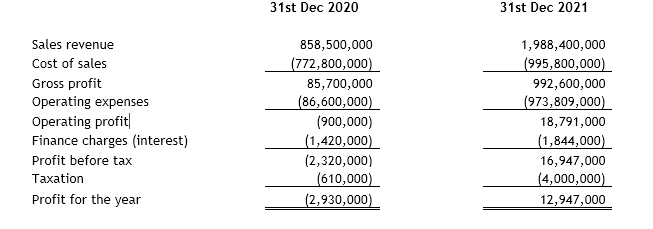

Linda Ltd Income Statements for the year ended

You are required to:

- Use your Excel skills to calculate the following ratios for both years.

You should then present your calculated ratios within your report in a simple table format for ease of comparison. (15% weighting)

a. Gross profit margin

b. Contribution margin

c. Operating profit margin

d. Return on Equity/investment

e. Asset turnover

f. Liquidity ratio

g. Current ratio

h. Inventory days

i. Trade receivable days

j. Trade payable days

k. Gearing ratio

2. Compare the performance for both years in the 3 key areas of profitability, efficiency, and liquidity using the ratios calculated in part 1 and make a recommendation as to whether Linda Ltd should proceed with expanding manufacturing of their new HEE, Linda David. Marks will be awarded depending on the depth of discussion. (25% weighting)

PART C

Linda Ltd has experienced fluctuating consumer demands since the beginning of the Covid-19 pandemic but are cautiously optimistic now that restrictions appear to be easing.

Their latest product is a new Heavy Electric Equipment (HEE) called Linda David and other partners have a supply chain through which they import components and HEE batteries from Europe.

1. The management of Linda have asked you to discuss specific issues that could impact both the manufacturing and production of the Linda David HEE, and consumer demand for the product; you were also asked to consider how flexible budgets could aid in the possible issues. Issues should be in context with the given scenario and current economic climate. You should conduct appropriate research using academic sources to generate ideas and discussion. Marks will be awarded depending on the depth of discussion.

Your analysis will be presented to the senior management of Linda, hence, your discussion on the above should be presented as an infographic. For this you are required to use the adobe creative cloud tools of your choice, however, you are told that Adobe Express might be the best tool to utilise in this case.

Are You Looking for Answer of This Assignment or Essay

The post QHO320: You are required to produce a budget report, complete with analysis and commentary, on a given scenario: Understanding Finance, Budget report , SU, UK appeared first on Students Assignment Help UK.