Question 1

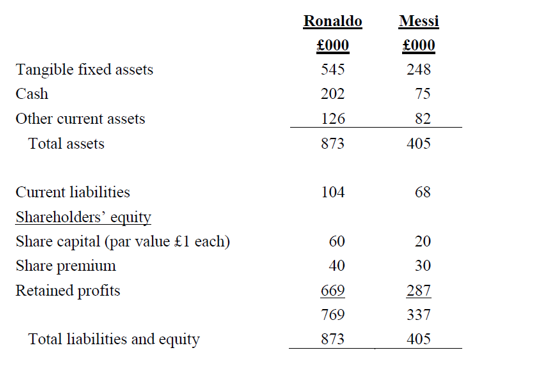

As at 31 December 2014, the summarised balance sheets of Ronaldo and Messi were as follows:

On 1 January 2015, Ronaldo acquired all of the shares in Messi in exchange for 40,000 of its own newly issued shares, the fair value of which is £21 per share.

You are also given the following information:

(1) Included within Messi’s tangible fixed assets is property with a net book value of £100,000, which originally cost £250,000. This fixed asset (which is being depreciated on a straight-line basis over 10 years) has been appraised as having a fair value of £400,000. No revision has been made to its overall estimated useful life.

(2) Over the years, Messi has been able to build up valuable brands. Professional experts have valued these brands at £150,000 as at 1 January 2015.

(3) The Company uses the partial goodwill method.

Required:

(a) Using the information above, prepare a consolidated balance sheet as at 1 January 2015 under the Purchase method.

(b) Repeat part (a) for the case where Ronaldo pays £600,000 in cash (financed by a new issue of debt) in order to acquire 75% of the shares in Messi.

(c) Using the same information, but assuming that Ronaldo pays £200,000 in cash in order to acquire 25% of the shares in Messi, prepare a balance sheet as at 1 January 2015 in which the investment in Messi is accounted for using the Equity method. Repeat this part using the Proportionate consolidation method.

Question 2

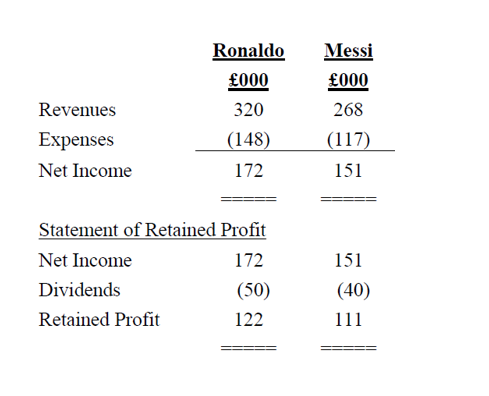

Here is information on the revenues, expenses, dividends and retained earnings of Ronaldo and Messi for the year ended 31 December 2015:

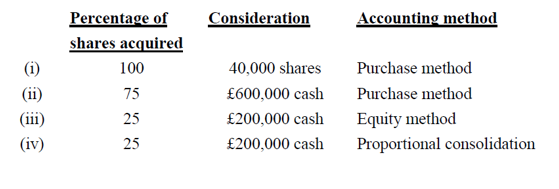

No entry has been made by Ronaldo in respect of the dividend that it will receive from Messi. Using the information above (including information in Question 1 on fair value adjustments), prepare a consolidated income statement for the year ended 31 December 2015 under each of the following four scenarios:

Note: where appropriate, assume that:

(a) Goodwill is impaired by 5% in 2015. Assume that under the Equity method goodwill is not recognized as a separate element, and hence is not subject to impairment.

(b) Other intangibles are amortised on a straight-line basis over 10 years. Recall that at acquisition, tangible fixed assets have a remaining useful life of 4 years.

(c) Any debt issued pays annual interest at a rate of 10%; cash balances do not earn any interest.

- 100% shares acquired – Purchase Method

- 75% shares acquired – Purchase Method

- 25% shares acquired – Equity Method

- 25% shares acquired – Proportional Consolidation

Question 3

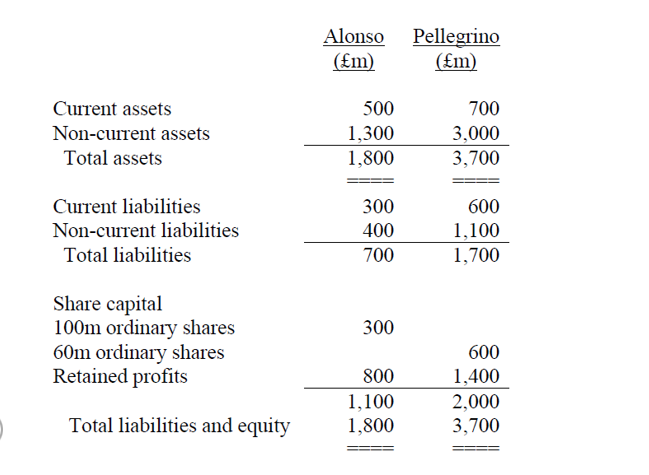

The balance sheets of Alonso and Pellegrino on 30 September 2012 were as follows:

On 1 October 2012, the two companies announced that they have entered into an unconditional agreement under which Alonso will acquire 100% of the ordinary shares of Pellegrino by issuing 2.5 new shares for each existing share of Pellegrino. The announcement is completely unexpected by the market.

(1) Assuming that:

(a) the share price of the two companies at the close of business on 30 September 2012 were Alonso – £12, Pellegrino – £30

(b) the market does not expect any synergies to arise from the transaction,

Calculate the two share prices immediately after the announcement and prepare a consolidated balance sheet that accounts for the transaction as a reverse acquisition. How would your answer change if Pellegrino were an unlisted company (i.e., the fair value of shares were not clearly evident)?

Consolidated Balance Sheet – Reverse Acquisition

(2) Repeat part (1) under the assumption that the market believes that the transaction will give rise to synergies with a value of £600m.

(3) Briefly comment on your results to parts (1) and (2).

Question 4

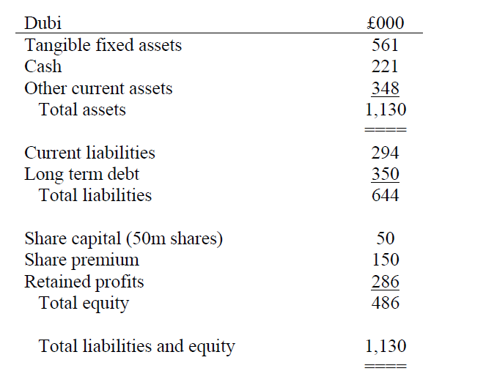

As at 1/1/2015, the summarised balance sheet of Dubi was as follows:

On that date, Zubi agreed to acquire 100% of the common stock of Dubi in exchange for the following consideration:

(1) cash of £500,000

(2) 40,000 shares of Zubi common stock – before the transaction, Zubi had 360,000 outstanding shares

(3) assumption of Dubi’s long term debt; this debt (which matures on 31/12/2019) has a face value of £320,000 and pays an annual coupon (on 31/12 each year) of 7%; the current yield to maturity on publicly traded debt with a similar credit risk is 7%.

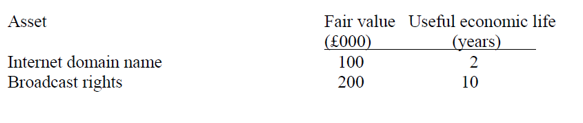

The fair values of cash, other current assets and current liabilities are all equal to the respective book values. However, included within tangible fixed assets are assets with a net book value of £100,000 that have been assessed as having a fair value of £280,000. Additionally, the following two intangible assets have been identified:

The deal announcement on 1/1/2015 was completely unanticipated by the market; hence, the price of Zubi’s common stock on 31/12/2014 of £27.00 per share does not impound any bid expectations.

Required

1) Assuming that the transaction is not anticipated to generate any synergies, that the value of both Dubi and Zubi’ long term debt will be unchanged by the transaction and that the price paid for Dubi does not include any premium, calculate the fair value of the consideration. What will be the price of Zubi’s common stock immediately after the announcement of the transaction?

2) How would your answer to (i) change if the transaction were expected to generate cost savings with a present value of £3,000,000 but the price paid for Dubi still does not include any premium?

3) Using your answer to part (i), compute the amount of goodwill arising on the transaction.