Question 1

Raven plc Company wants to acquire a new machine costing £12 million. It has an expected operating life of 3 years, with a scrap value of £500,000 at the end of its life. Maintenance costs for the machine will be £600,000 per year.

Raven plc can acquire the machine on a 3-year operating lease for lease payments of £3.5 million per year, paid annually in advance. Alternatively, the machine can be acquired on a 3- year financial lease for lease payments of £3 million per year, paid annually in advance.

Raven plc pays tax at 19%, 12 months in arrears. The company’s after-tax loan interest rate is 10%.

Required:

- Compare the key characteristics of a financial lease with those of an operating lease.

- Evaluate whether it is cheaper for Raven plc to acquire the machine on an operating lease or on a financial lease. ( Your workings should be to the nearest £m)

- Explain why might your advice is given in (b) above change if you were told that the machine’s technology is subject to rapid change.

Question 2

Bullock Company’s finance director is concerned that the company might be overtrading and, as a result, is considering using the services of a factoring company as a means of obtaining additional finance for working capital.

Bullock has currently got a sales turnover of £11 million and its terms of trade are payment in 60 days. Average receivables are £2.58 million and annual bad debts are 0.5% of sales turnover. The company’s bank overdraft interest rate is 5%.

Armadi Factoring has offered a non-recourse factoring service for a fee of 1% of turnover and would advance 80% of average receivables at 6% interest. It would expect to reduce the credit period taken by Bullock customers to 60 days. Bullock expects to make administration cost savings of £50,000 per year if it used a factoring company to manage its accounts receivable function.

Required:

- Write a memo to Bullock’s managing director that outlines the meaning, causes, and dangers of overtrading; how overtrading might be identified and what the possible solutions are to the problem.

- Undertake financial analysis of the proposal to use the services of Armadi Factoring and briefly discuss the advantages and disadvantages of using a debt factoring service

Question 3

- Discuss the causes and possible solutions to the “capital rationing” problem in investment appraisal.

- Dave Company currently has £45m of positive NPV investments it wishes to undertake. However, this year’s capital expenditure budget has been set at only £20m.

As a result, the finance director is considering a £25m rights issue of new equity to avoid a capital rationing problem. Dave Company currently has 40 million shares in issue, each with a market price of 440p.

Two possible rights issues are under consideration. The first is at only a small discount to the current share price: a 1-for-4 rights issue at 400p per share. The other is at a much deeper discount to the current share price: a 1-for-2 rights issue at 200p per share.

Required:

Using as an example an investor who holds 1,000 Dave Company shares, demonstrates that neither of the two rights issue proposals will affect shareholder wealth.

Question 4

Stoke plc is a UK-based paint manufacturer. The company imports raw materials and exports paint products world-wide. You have recently joined the company in the treasury management department with specific responsibility for foreign exchange risk management.

Currently, the company has the following unhedged foreign exchange transactions:

- A receipt of $4,800,000 in one month’s time

- A payment of $3,000,000 in one month’s time

The company’s bank has provided the following information:

Spot rate ($ per £): 1.2575 +/-0.0003

One month forward rate ($ per £): 1.2620 +/-0.0004

Loan Deposit

£ Interest rates (per annum): 5.8% 3.0%

$ Interest rates: (per annum): 6.0% 4.0%

Required:

- Briefly discuss the different types of foreign exchange risk and their importance in the financial management of a company.

- On the basis of the information given above calculate the bid and offer spot, one month forward rates and evaluate and recommend the best way that Stoke plc can manage its foreign exchange risk.

- Discuss how options contracts differ from other foreign exchange risk management techniques.

Question 5

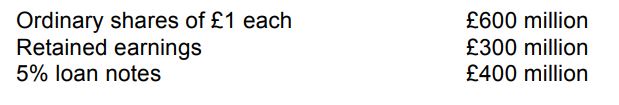

Brunfeld is a global shipping company, which has the following capital structure according to its Statement of Financial Position at 31 March 2019:

The above loan notes are redeemable at par in 10 years time and have a current market value of £90 per £100 nominal. Interest on the loan notes is paid annually in arrears and is allowable for tax at a rate of 19%. Tax is paid at the end of the year in which profit arises.

The ordinary shares have a current market value of £6 per share and an equity beta of 0.9 The current return on Government gilts is 6% and average annual returns from global stock markets are 14%.

Required:

- Calculate the weighted average cost of capital for Brunfeld at 31 March 2019.

Brunfeld is considering expanding the number of ships it has, using a £600 million further issue of 5% loan notes to finance this. It is expected the loan notes will have the same market value of £90 as the existing loan notes. It is believed that taking on the project will raise the market value of ordinary shares to £7 per share.

Required:

- Use the capital asset pricing model to calculate the new required rate of return on equity at the new level of gearing for Brunfeld.

- Discuss factors that may change the equity beta of a company.

- Explain the limitations of the capital asset pricing model.

Question 6

Boom is a company that has cash available to invest and is considering the purchase of either a competitor’s business or an attractive bond investment instead. This bond investment will pay a coupon rate of 8% in arrears for 3 years, when it will be redeemed at par. Similar bonds are providing a yield of 5%. Ignore taxation. Boom is concerned that it pays a reasonable price for whichever of the two options it chooses.

- What price should Boom pay to buy the bond per £100 nominal value.

- Advise Boom on methods it could use to value its competitor business.