The aim of this project is to develop the students’ ability to critically analyze accounting issues and to apply accounting knowledge to solve problems (L01). As well as to improve the student’s skills in terms of work effectively in teams (L05).

Part One:

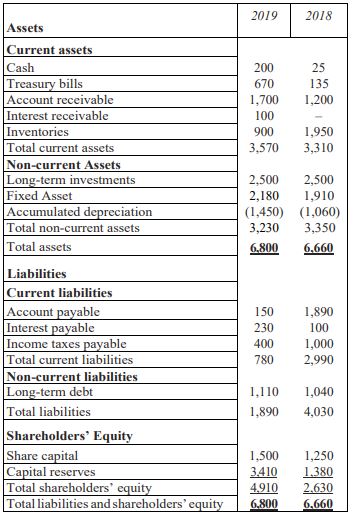

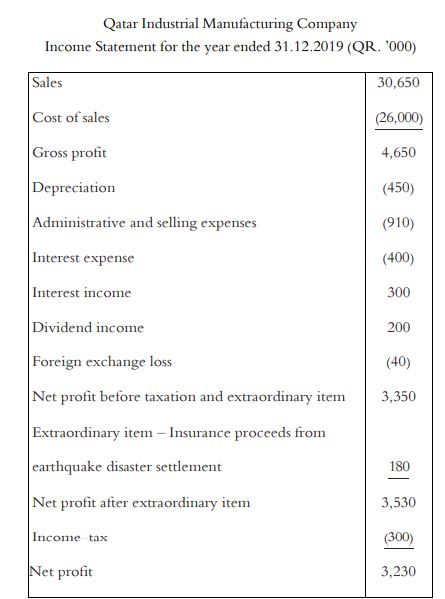

Qatar Industrial Manufacturing Company provided you with the comparable balance sheet (2018/2019) and income statement for the year-end 2019 as well as additional related information and required you to:

1. Prepare a statement of cash flows using the direct method for the year ended 31 December.

2. Prepare a statement of cash flows using the indirect method for the year ended 31 December.

Qatar Industrial Manufacturing Company Statement of financial position for the year ended 31 December (QR ’000)

Notes: The following are additional information to use for preparing cash flow statement (figures are in Rs.’000).

(1) An amount of 40 as Tax deducted at source on dividends received (included in the tax expense of 300 for the year).

(2) There is 250 was obtained from the issue of share capital and another 250 was obtained from long-term loans.

(3) Account receivable and Account payable include amounts relating to credit sales and credit purchases only.

(4) The company acquired fixed assets during the year for 350 and the payment was made in cash.

(5) The company sold the equipment at a price of 20. The equipment was purchased by the company at a price of 80 and the accumulated depreciation at the time of selling was 60.

(6) An amount of QR40 as foreign exchange loss was due to the reduction in the carrying amount of short-term investment in foreign-currency designated bonds arising out of a change in the exchange rate between the date of acquisition of the investment and the balance sheet date.

(7) Paid cash dividends of 1,200.

Part Two:

After the experience of preparing the cash flow statement, answer the following question.

1. What did you learn from the statement of cash flow that you prepared in terms of how to evaluate the financial health of the company (discuss this from point of view of an investor, an owner, a creditor)?

2. What is the relationship between profit and cash? Explain your answer.

3. It is relatively easy “to manufacture profit, but virtually impossible to create cash”. Discuss this statement.

4. Why non-cash transactions important? Explain your answer.

5. The direct method of preparing the statement of cash flows is the easiest to understand, but most companies use the indirect method. Why do you think this might be so?

6. A big number of countries requiring International Financial Reporting Standards (IFRS) whereas some countries do not require companies to use IFRS and they follow the US. GAAP. Discuss in detail the differences between preparing cash flow statements according to International Financial Reporting Standards (IFRS) and according to the US. GAAP