This project is designed to acquaint students with the application of forecasting techniques in business. This involves planning research, collecting data, carrying out appropriate tests, analysing data using regression analysis

ECON1064 Assignment Instructions:

This project is designed to acquaint students with the application of forecasting techniques in business. This involves planning research, collecting data, carrying out appropriate tests, analysing data using regression analysis, and writing a business report based upon this empirical work.The assignment needs to be completed as a group of 3-4 students officially registered on Canvas. In exceptional circumstances, you may be allowed to complete it individually.Scope: maximum of 6 pages submitted (excluding cover sheet, Report title page, Report index (optional), References and appendix).Submission: Via Assignments folder in Canvas.

Only one submission is required per group. It is very important that you submit an assignment cover sheet with all the group members’ signatures/names at the time of submission. All students listed on the cover sheet will receive the same mark. If any dispute arises on your contribution to the group work, the cover sheet will be used as evidence of contribution.Marks: This project comprises 100 marks and will contribute 50% to your overall grade.

Problem description:

The stock market can have a profound economic impact on the economy and individual consumers. Financial analysts and economists are often interested in analysing and predicting stock price movements. One basic analysis is modelling the relationship between future and past (lagged) stock returns of individual companies. If an accurate prediction of future stock prices can be made based on past values, the monetary benefits can be substantial. You and your team members have recently been hired as financial analysts by Fortuna Capital Management. Your first assignment is to examine and forecast a company’s stock price movements.

Data: Your first task is to find and download the relevant data. To do this, you will need to go to the Investing.com – Stock Market Quotes & Financial News website and search for the required data. You may choose a US listed company as well if you wish. Here are a few pointers to help you collect your data:

- Choice of company: You will need to pick a company you are interested in exploring. Thechoice is yours – you can choose any company listed on the Singapore or Australian (or US) stock exchange (just check the company has the required data on the website).

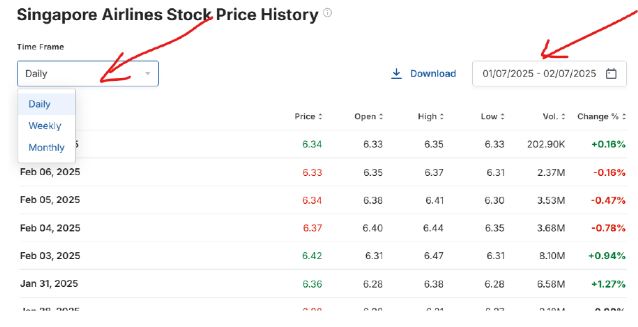

- Time interval: Here you will need to choose between daily, weekly, or monthly data. You can use any or all these time intervals.

- Timeframe: You will work with the most recent data and determine the time period, whichwill depend on the time interval(s) you have chosen in 2). We recommend data from the past 6 months as minimum for daily data (longer for weekly or monthly). (approx. 150 data points)

Once you have selected your 1) company, 2) time interval/s, and 3) timeframe, you can download the data from the Investing.com – Stock Market Quotes & Financial News website. If you click on Markets>>Stocks it’ll take you to the data webpage. You may also like to change the ‘World Markets’ option to, say, Singapore.

Do You Need help with ECON1064 Assessment 2 of This Question

Order Non Plagiarized Assignment

The data you will download will have an extension csv.

IMPORTANT: Say you choose to work with Singapore Airlines stock data. The data will be available under the ‘Historical data’ tab. By default, the most recent data is at the top. If you click on “Date”, it will reverse the order. Next, you will need to set the frequency to ‘daily’, ‘Weekly’, or ‘monthly’ for you chosen time period, and press Apply before you download your dataset (download button is just below ‘Apply’).

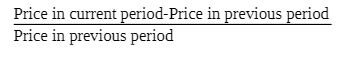

Your next task is to calculate daily/weekly/monthly returns for the Open prices (which is the opening price for the day/week/month and is also the last recorded price for the previous day/week/month). Recall that RETURN is calculated as:

Your next task is to calculate daily/weekly/monthly returns for the Open prices (which is the opening price for the day/week/month and is also the last recorded price for the previous day/week/month). Recall that RETURN is calculated as:

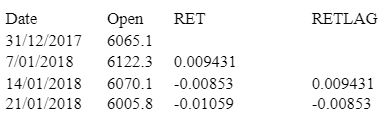

Classification: Trusted For example, if weekly time interval is used: Weekly Return = (Price in current week – Price in the previous week)/Price in the previous week. For example, given the below table, returns for the week starting 7/01/2018 is calculated by: (6122.3-6065.1)/ 6065.1=0.009431. You can name this variable as “RET”. You can also create lagged returns (RETLAG) as this is just the return from the previous week:

You can now begin your analysis. [Note: Questions need to be answered in the order they have been asked, with appropriate headings for different sections in the Report.]

Grading: 85 marks for statistical analysis and report + 15 marks for presentation

ECON1064 Required:

- Start your business report with a formal introduction stating the background of the company, why you are studying its stock price movements, and what is the objective of your analysis. Discuss your choice of time interval/s (daily, weekly, monthly), and the time period. [You are encouraged to cite any relevant media, website and/or journal articles.] (15 marks)

- Conduct a preliminary analysis on your data: 1) present your data graphically and discuss the results; 2) explain whether transformation/ adjustment/ decomposition is needed for your data (note you don’t need to transform/ adjust/ decompose the data, just to explain what is required); 3) plot the ACF of the company’s returns and discuss. Do the returns look like white noise? Explain your answer. (20 marks)

- Continuing the preliminary analysis, calculate and present descriptive statistics (mean,median & standard deviation) for the stock returns, and discuss the results. (15 marks)

- In this section you are required to use regression analysis to test the predictive power of past returns (RETLAG) X on future returns (RET) Y. Write down the regression equation, specifying the X and Y variables. Create a table that summarises the following key measures of your regression analysis –adjusted R-Squared, the slope parameter, and the P-Value of the slope. Discuss your results, commenting on each of the measures. (20 marks)

- Summarise your findings and provide conclusions. Include any relevant recommendations that you believe could improve your analysis. In particular, discuss variables and methods that you can potentially use to obtain better forecasts. (15 marks